Overview

In the rapidly evolving landscape of cryptocurrencies, Bitcoin stands as a prominent financial entity, characterized by significant price fluctuations influenced by both market dynamics and online sentiment. This project aims to leverage advanced machine learning techniques to predict Bitcoin price movements using historical price data and sentiment analysis extracted from online forums. The study utilizes state-of-the-art models and methodologies to enhance prediction accuracy, contributing insights valuable to traders and investors in the cryptocurrency market.

Methodology

Data Collection

- Historical Price Data: Collected daily Bitcoin price data spanning several years from reliable cryptocurrency data providers.

- Sentiment Analysis: Extracted sentiments from Bitcointalk forum discussions using both VADER (Valence Aware Dictionary and sEntiment Reasoner) and FinBERT (Financial BERT), a specialized language model for financial sentiment analysis.

Model Development and Implementation

- Long Short-Term Memory (LSTM): Chosen for its ability to capture sequential patterns in time-series data, LSTM models were employed to predict Bitcoin price trends and actual prices.

- Feature Integration: Integrated sentiment scores from VADER and FinBERT alongside historical price data as features for LSTM model inputs.

Hyperparameter Tuning

- Optimization: Conducted hyperparameter tuning to enhance model performance, leveraging techniques such as grid search and cross-validation to find optimal LSTM configurations.

Model Evaluation

- Classification (Trend Prediction): Evaluated model performance in predicting upward or downward trends using metrics such as accuracy, precision, recall, and F1-score.

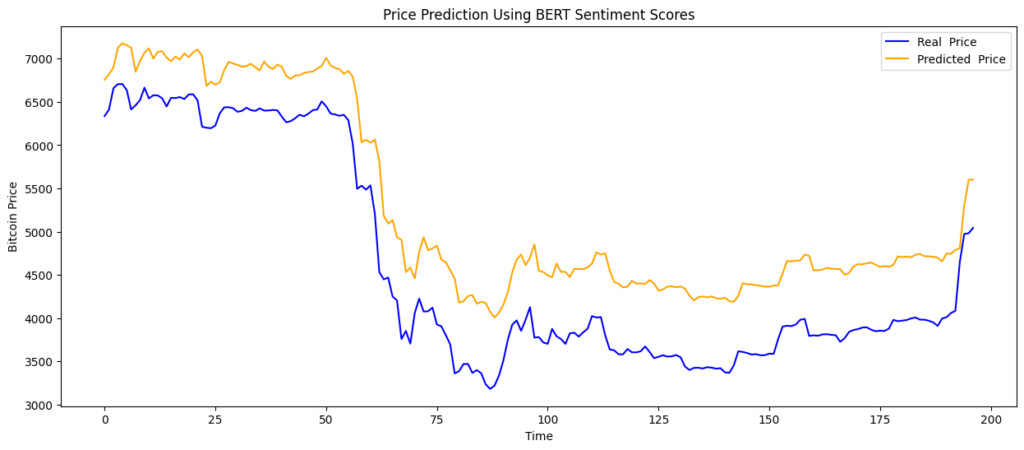

- Regression (Price Prediction): Assessed the accuracy of predicted Bitcoin prices against actual values using metrics like Mean Absolute Error (MAE) and Root Mean Squared Error (RMSE).

Model Deployment

- Deployment Strategy: Designed a deployment pipeline to operationalize the LSTM model for real-time or batch predictions.

- Scalability Considerations: Ensured the model architecture and deployment infrastructure are scalable to handle large volumes of data and user requests.

Results and Insights

- Performance Comparison: Found that models incorporating sentiment scores from FinBERT outperformed those using VADER in predicting Bitcoin price trends.

- Accuracy in Price Prediction: Models relying solely on historical price data demonstrated lower error metrics when predicting actual Bitcoin prices, emphasizing the critical role of historical data in price forecasting.

- Practical Implications: Provided actionable insights into market sentiment dynamics and their impact on cryptocurrency price movements, aiding decision-making processes for traders and investors.

Industry Use Cases

- Financial Institutions: Insights from this study can inform trading strategies and risk management practices within financial institutions active in cryptocurrency markets.

- Investment Firms: Helps investment firms optimize portfolio management by integrating sentiment-driven insights with traditional financial analysis.

- Retail Investors: Provides individual investors with tools for making informed decisions based on sentiment analysis and historical price trends.

Conclusion

This project demonstrates the efficacy of integrating advanced sentiment analysis techniques with LSTM models for predicting Bitcoin price movements. While sentiment analysis enriches understanding of market sentiment and trend direction, the foundation of accurate price prediction remains grounded in robust historical data analysis. Future research could explore additional sentiment analysis models and further refine predictive models to enhance accuracy and applicability in dynamic cryptocurrency markets.

By combining cutting-edge machine learning methodologies with comprehensive data analysis, this study contributes to advancing predictive capabilities in the cryptocurrency domain, offering practical solutions for stakeholders navigating the complexities of Bitcoin investment and trading.